- FX strategy

- FX tool for start ups

- Critical FX pain points faced by finance teams

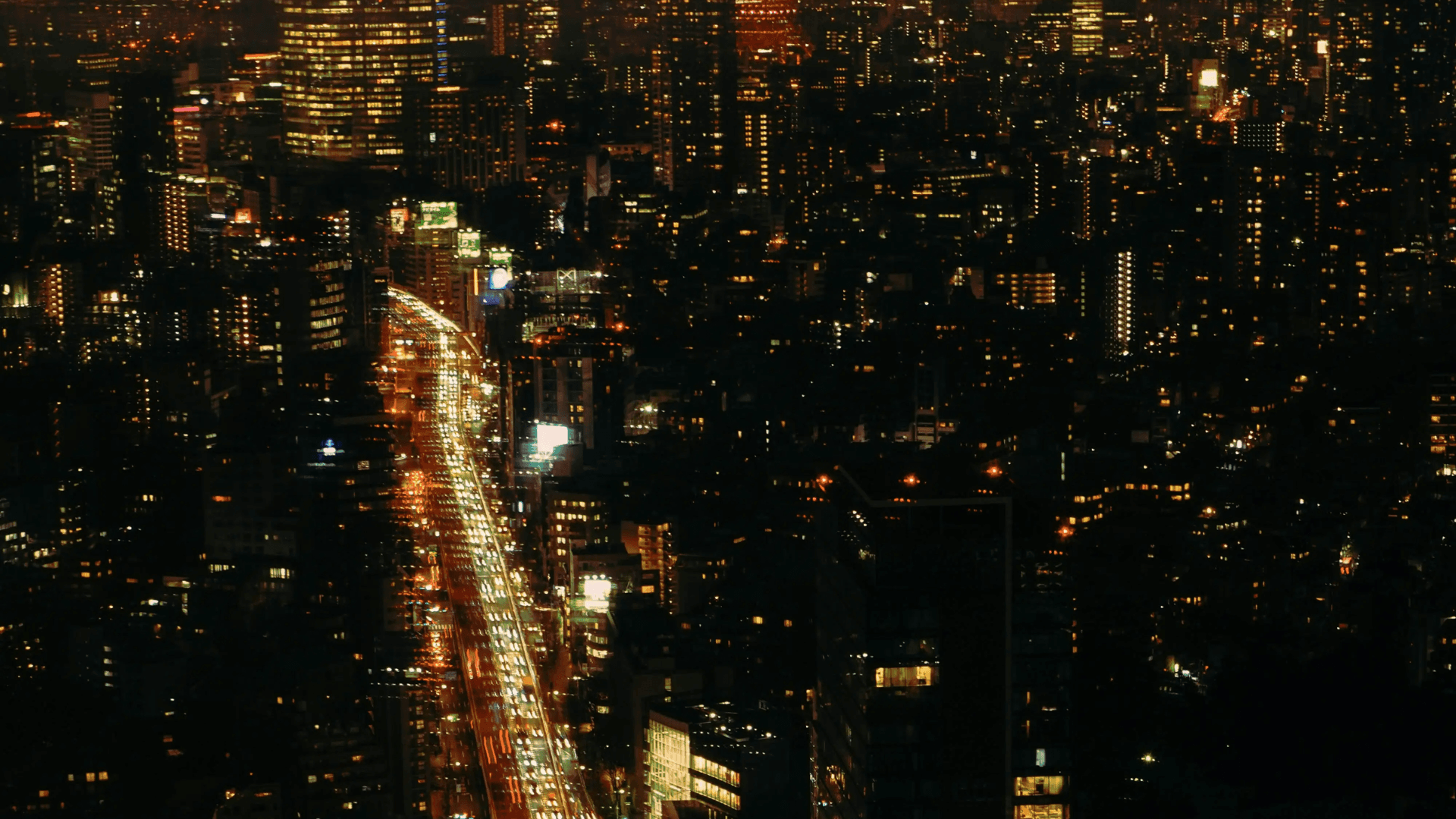

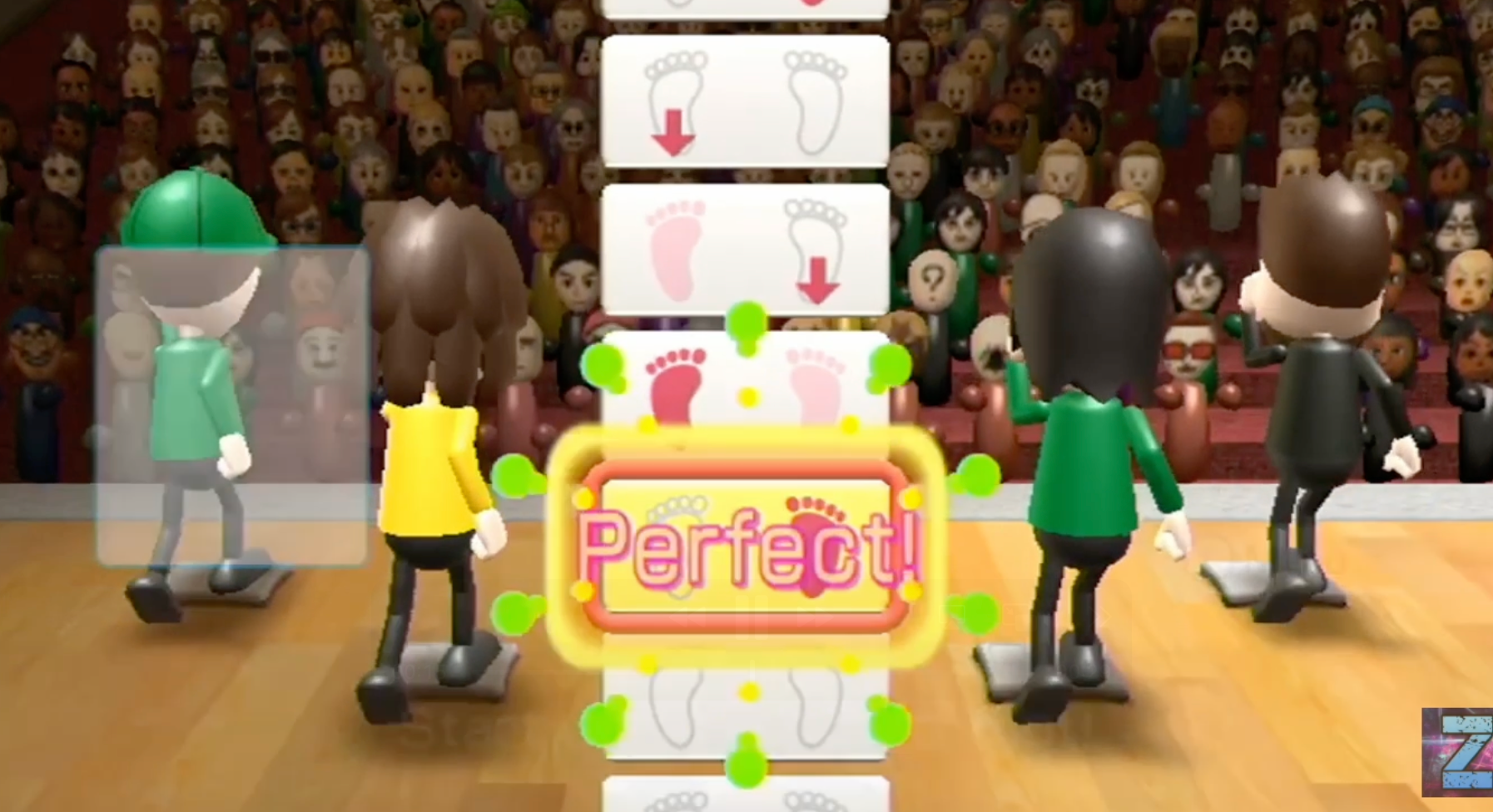

In 2011, Nintendo reported a staggering U$926m loss.

Some of this was attributed to declining hardware and software sales. In my humble opinion, I think that the average consumer realised that following the Wii Fit program and doing ‘basic steps’ everyday wasn’t going to help you go down a waist size (IYKYK). But a majority of the loss could be attributed to FX, U$690.5m to be exact, driven by adverse movements against the U.S. dollar and euro.

The same problem 15 years later is impacting Aussie businesses…

For businesses operating across multiple currencies, FX volatility represents one of the most underestimated threats to profitability. The impact is particularly severe for Australian SMEs engaged in international trade, with the Australian dollar experiencing its largest single-day decline of 4.5% outside the global financial crisis in April 2025 following tariff announcements, demonstrating how rapidly currency movements can erode margins.

These losses are largely preventable with proper risk management, yet many Australian businesses continue to operate without adequate hedging strategies.

Why? Because it’s put in the ‘too hard’ basket. And similar to Nintendo, FX strategy becomes reactive.

So what are the three critical pain points when it comes to FX?

1. Lack of real-time visibility

The most fundamental challenge facing businesses is the inability to maintain real-time visibility into foreign exchange exposures across global operations. Many companies still rely on spreadsheet-based tracking systems that cannot scale to the complexity of modern multinational operations.

When you're managing transactions across dozens of currencies and hundreds of counterparties, spreadsheets simply can't keep pace. By the time finance teams consolidate exposure data from multiple ERP systems and banking relationships, the market has already moved and opportunities to hedge at favourable rates have evaporated.

2. The ‘time-lag’ problem

Transaction risk can create large losses when companies commit to future cash flows in foreign currencies without adequate hedging. Consider an Australian manufacturer receiving a Chinese order for CNY $6.0m (approximately AUD 1.2 million). With standard 90-day payment terms, a currency movement from 1 AUD per 5 CNY to 1 AUD per 6 CNY results in a AUD 200,000 loss. ~17% of revenue wiped out purely by exchange rate fluctuations.

For manufacturing companies operating on 10-15% margins, this type of currency-driven loss can instantly convert profitable orders into loss-making transactions.

3. Inadequate forecasting and scenario planning

Many companies fail to perform scenario analysis to understand how exchange rate changes would affect financial performance. Without "stress testing" currency rates at various levels, businesses remain unprepared when sudden fluctuations occur.

The 1997-1998 Asian Financial Crisis demonstrated this catastrophically: companies with dollar-denominated debt but local currency revenues faced bankruptcy when currencies depreciated 30-40% in months.

What does real time FX strategy and management look like?

This is where Primary's FX management tool transforms the equation. Instead of a reactive attitude, Primary enables proactive, real-time management:

Track exposure limits in real-time

Primary consolidates your currency exposures across all operations, providing instant visibility into your FX position. You can see all of your currency balances in one place and real time changes in currency valuations.

Implement a hedging strategy

Design, execute, and oversee your hedging strategy directly within Primary. Manage hedges held with Primary and external providers in one consolidated view, track hedge coverage against underlying exposures, and book FX trades across all required currency pairs.

Quantify risk in dollars

Rather than abstract percentages, Primary translates currency exposure into actual dollar impact on your business. You'll know precisely how a 5% or 10% currency movement would affect your cash flow and profitability, enabling informed hedging decisions aligned with your risk tolerance.

Execute hedges before the next swing costs you

With real-time alerts when exposures approach policy thresholds, Primary enables you to execute hedges during normal market conditions when liquidity is ample and transaction costs are reasonable. No more reactive hedging during periods of elevated volatility when execution costs spike.

The bottom line

Currency volatility isn't going away. Geopolitical tensions, divergent monetary policies, and trade uncertainties ensure that FX risk will remain a critical challenge. The question isn't whether your business faces currency exposure-it's whether you're managing it proactively or waiting for the next costly surprise.

Primary's FX management tool gives CFOs and treasury teams the visibility, quantification, and execution capabilities needed to protect profitability in an uncertain currency environment.

About Primary

Primary provides modern treasury management solutions for complete cash visibility, idle cash optimisation, and FX risk management - all in one platform.